Financial Solutions Made Easy

Providing funding, financial services & financial resources to small businesses and ambitious individuals.

Getting Financing

is easy!

Apply Online

Kick off the process with a simple online application, available 24/7 for your convenience.

Get Pre-Qualified and Pre Approved

With our streamlined process, we can quickly determine your eligibility and loan terms.

Get Final Offer

Discuss the final details, review the terms, and receive your funds in a timely manner.

How do I quality for our

How Does it work?

Choose the funding you need

We offer a variety of flexible funding options tailored to your business goals, from revolving lines of credit to unsecured business loans and 0% interest credit strategies. Whether you're starting up or scaling, we’ve got you covered.

Apply in seconds

We’ve made applying for funding as easy as possible. Apply through our website today and get a result in minutes. It’s really is that simple.

Get a dedicated agent

Once you’ve been approved for funding you’ll receive a dedicated agent. They will assist you and help you get your funds as fast as possible.

Collect Necessary Documents For Closing

Preferred Lending Option

We Help Startups and Established Businesses secure 0% interest funding from $ 50,000 to $250,000 + with fast approval in 30 Days or Less

✅0% Interest for 12 - 18 Months

✅ Flexible Payment Options

✅ Apply In Under 2 Minutes

✅ We fund Startups & New LLCs

✅ No Financials Or Tax Returns

200+

Satisfied Customers

3+

Years of Experiance

$2M+

Total Amount Funded

200+

Helped Startups

Funding Options LIST

The following below are a list of financing options that we specialize in securing:

0% Business Capital

Secure $50,000 to $250,000 in 0% interest funding through a proven Credit Stacking strategy. Perfect for startups and growing businesses ready to scale without high-interest loans.

Business Credit Lines

A business credit line is a flexible financing option that provides businesses with access to funds up to a predetermined limit, which they can draw from as needed.

Syndicated Term Loans

Do you need money for investments, high-ticket services, debt consolidation, or start-up capital? We can help! NO upfront fees and absolutely.

🏚️

Real Estate Financing

Real estate financing provides funds to buy, develop, or improve property. Options like mortgages, commercial loans, and construction loans cater to residential or commercial needs, with terms based on the property’s purpose. These loans, often secured by the property, make real estate investment more accessible by spreading out costs over time.

SBA Loans

SBA loans are government-backed loans provided through the U.S. Small Business Administration, designed to support small businesses with favorable terms and lower down payments. Available for various needs like working capital, equipment, or real estate, SBA loans offer accessible funding with longer repayment terms, making them a popular option for business growth and expansion.

Working Capital / Revenue Based Financing

Working capital revenue-based financing provides businesses with quick access to funds based on monthly revenue, ideal for short-term expenses and growth. Repayments are made as a percentage of revenue, allowing flexibility that aligns with cash flow, making it a useful option for businesses with fluctuating income.

Testimonials

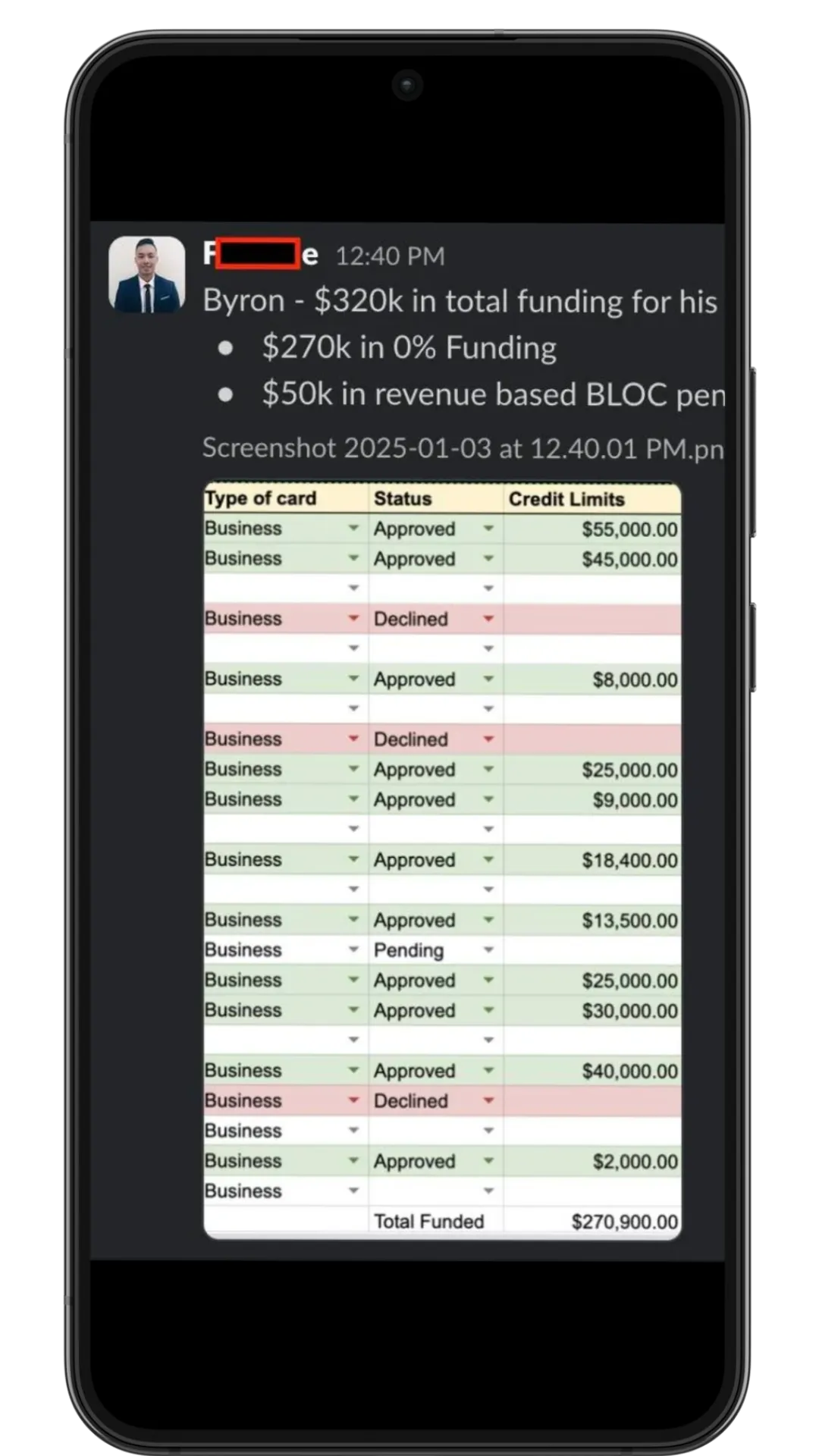

Byron D.

Restaurant - Texas

Secured $270,000 at 0% in 45 days

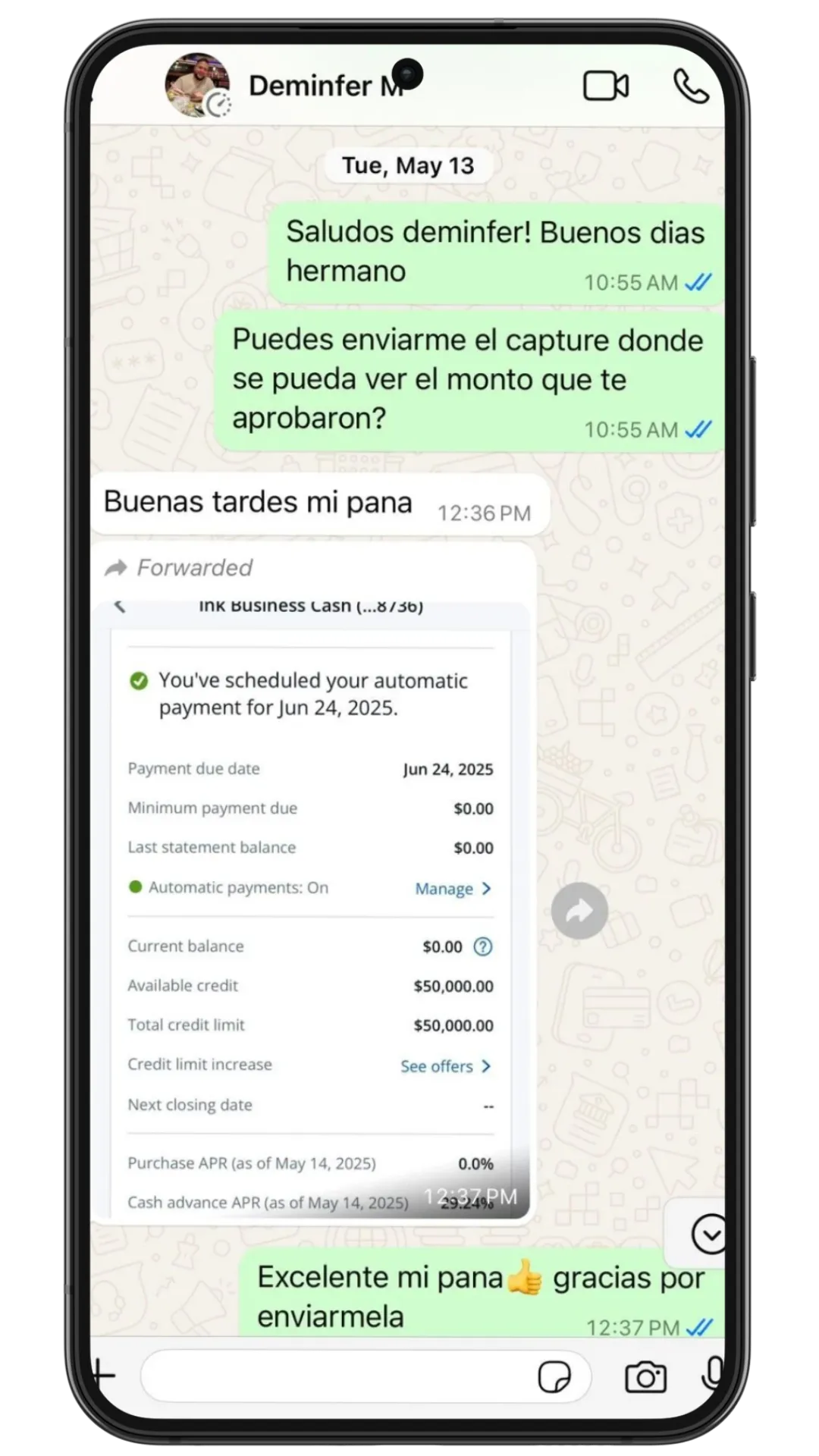

Deminfer M.

Automotive Services - Indiana Secured $50,000 at 0% in 7 days

Mark C.

Food Truck - Florida

Secured $72,500 at 0% in 30 days

FAQS

What is 0% Business Capital?

It’s a funding strategy based on business credit cards that allows you to access $50K–$150K at 0% interest for an initial period, using a model known as Credit Stacking. Ideal for startups and growing businesses.

How does the application process work?

It only takes 2 minutes to complete the initial application. Then, our team analyzes your profile and guides you step-by-step to maximize your approval and funding amount.

What kind of credit do I need to qualify?

Ideally, you should have a FICO credit score of 700+, an average credit history of at least 2 years, 3 to 5 open primary accounts, and a personal credit card with a $5,000+ limit for comparable credit. Overall utilization should be below 30%. Your business should be at least 3 months old, with fewer than 3 inquiries per credit bureau. However, we evaluate each case individually and can offer tailored recommendations to strengthen your profile.

What if I have poor credit?

We can help you create a plan to improve your profile, add strategic accounts, or even use guarantors or co-applicants if necessary. We also offer free initial consultations.

How Much In Funding Am I Expected To Get?

It can vary based on personal and business credit history, your personal and business income (if any) the industry, length of time in business and a few other factors. The typical range we see for qualified businesses are $50k - $150k. If you have a business with qualifying documents that can help with contributing to a higher funded amount.

Does this type of funding affect my personal credit?

Not directly. We use business credit cards that typically do not report to personal credit. Additionally, we guide you to avoid impacting your score and help you maintain optimized credit profiles.

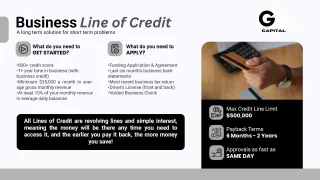

What is a Business Line of Credit (BLOC)?

It’s a type of financing that allows you to access funds as needed, up to a predetermined limit. You only pay interest on the amount you use.

What is a Syndicated Loan Term?

A Syndicated Term Loan is an unsecured personal loan of up to $500,000, ideal for investments, high-ticket services, debt consolidation, or starting a business. No registered business entity is required, and there are no hard credit checks.

How long does it take to receive funding?

Our clients typically receive approvals within 7 to 14 days, and full access to capital within up to 45 days, depending on the type of funding.

Are there any upfront costs?

We don’t charge upfront fees. Our model is transparent, and performance based.

Get In Touch

Address: 9783 E 116th st Num A291, Fishers Indiana 46037

Email: [email protected]

Hours of Operation:

Mon - Sat 8am to 6pm

Sunday – Closed

Facebook

Instagram

TikTok